reit dividend tax canada

Stocks with long track records of dividend growth tend to deliver strong total returns for patient RRSP investors. Then there is the property tax and the tax you will have to pay on the rental income.

John Heinzl S Model Dividend Growth Portfolio As Of Sept 30 2021 Dividend Investing Portfolio

For single filers if your 2021 taxable income was 40400 or.

. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. This mimics what the payout would have been if companies had not already paid tax on the income. The Top Canadian Uranium Stocks To Buy in June 2022.

Canadian Dividend Aristocrats Updates. 2 Great TSX Dividend Stocks to Buy Now and Own for 30 Years appeared first on The Motley Fool Canada. Calgary Alberta T2T5H7.

Preferred shares in addition to five. Key facts about BMO Canadian Dividend ETF. The best dividend ETFs in Canada use investor funds to buy and hold a basket of high-paying dividend stocks.

10 of The Best Canadian Dividend Stocks to Buy in June 2022. 10 of the Best Canadian Stocks to Buy in June 2022. The federal government adds a 38 to eligible dividends and 15 to non-eligible dividends to get a gross-up total.

Instead of picking individual dividend stocks on your own and worrying about diversification dividend ETFs are pre-designed to be diversified across various sectors and industries. For example if the tax of capital gains T cg is 35 and the tax on dividends T d is 15 then a 1 dividend is equivalent to 085 of after-tax money. The tax credit amount that can be claimed depends on the amount of foreign tax due and US.

The tax rate applied to dividend income is not what the individual taxpayer pays. 404 BMO Canadian Dividend ETF is a fund issued by the Bank of Montreal and it is managed by. Another exception is dividends earned by anyone whose taxable income falls into the three lowest US.

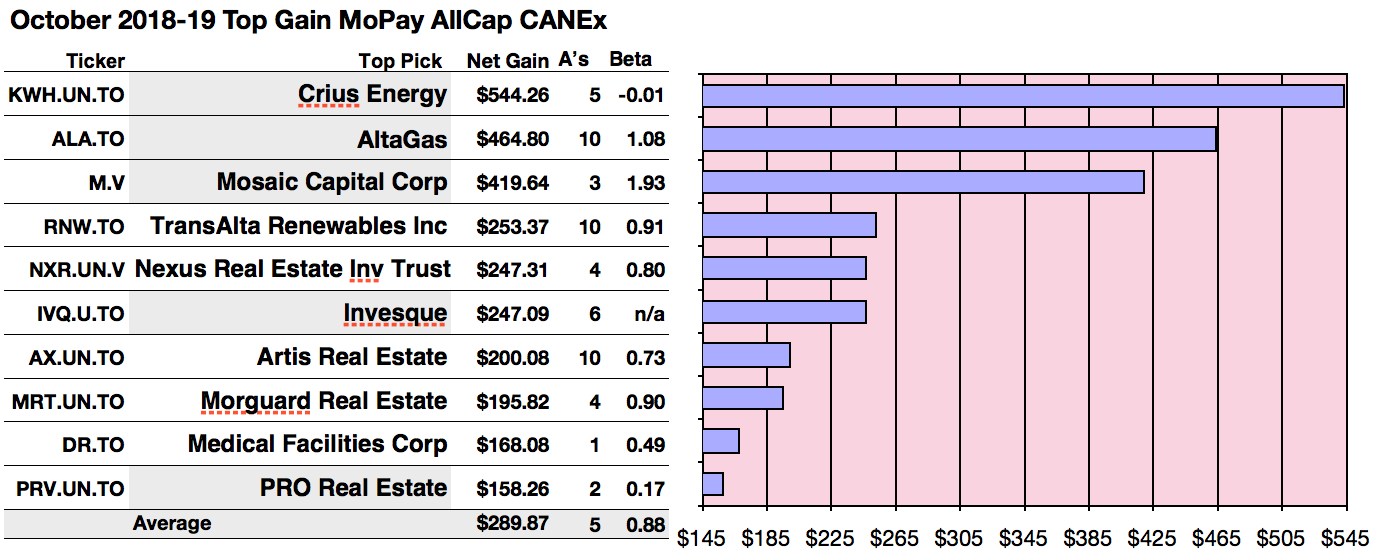

A portfolio for a Residential REIT might include high-rise mid-rise and low-rise apartment buildings multi-unit rental properties and single-family rental homesCanadian Apartment Properties REIT CARUN is Canadas largest REIT and owns more than 57743 units in Canada with an average monthly rent per unit of 1282 in 2020. The REIT structure was designed to provide a similar structure for investment in real estate as mutual funds provide for investment in stocks. 4 REIT ETFs you Need to be Looking at for June 2022.

For tax credits investors must fill out Form 1116 which can get complicated. 035 Management Expense Ratio MER. What is the dividend tax rate in Canada.

039 Assets Under Management AUM. 72209 million as of September 1 2021 Distribution Yield. Canadas average house price fell 63 month over month to 746000 in April as per data from the Canadian Real Estate Association CREA.

October 21 2011 Management Fee. It is yet another ETF launched and managed by BlackRock Asset Management Canada. Below are the 87 securities listed in the index as per the rules outlined above.

Canadas tax treaty with the United States also says that trust income. Before you go and agree or not with the index or the rules indexes are put together to attempt at categorizing certain stocks and investment strategies such as monthly income investing dividend investing or dividend growth investing. The after-tax drop in the share price or capital gainloss should be equivalent to the after-tax dividend.

Tax liability is less than foreign taxes paid. As for price appreciation the homes in that area have seen a massive increase from under 150000 in 2014. Federal income tax brackets.

The companys share price has since fallen as iron prices have since. NEW YORK May 19 2022 PRNewswire -- The InfraCap REIT Preferred ETF NYSE Arca. To get the same financial benefit from a capital loss the after-tax capital loss.

The Top Small-Cap Canadian Stocks To Buy In June 2022. PRO REIT is a Canada-based open-ended REIT with a focus on acquiring and managing commercial real estate properties. Investing in Canadian dividend-paying stocks qualifies the fund for tax credits which adds to its appeal.

Labrador Irons dividend which is closely tied to iron ore prices shot up when the commodity hit record highs in 2021. The Board of Directors of Prologis the Company sets high standards for the Companys employees officers and directors. This decline came as home buyers delayed their.

The REIT owns over 90 properties and roughly 44 million square feet of leasable area across Nova Scotia New Brunswick Alberta and. PFFR the Fund has declared a monthly distribution of 012 per share 144 per share on an annualized basis. It should be implemented by leaving the trusts alone and cutting corporate andor dividend tax to match the trust advantage.

The output of the Dow Jones Canada Dividend Index. Wachovia Hybrid and Preferred Securities WHPPSM Indicies. The post RRSP Investors.

24 Best Canadian Reit Stocks 2022 Invest In Real Estate

Introduction To Canadian Reits Seeking Alpha

Reit Taxation A Canadian Guide

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Reits Canada Still Offers Tax Advantages For These Investments

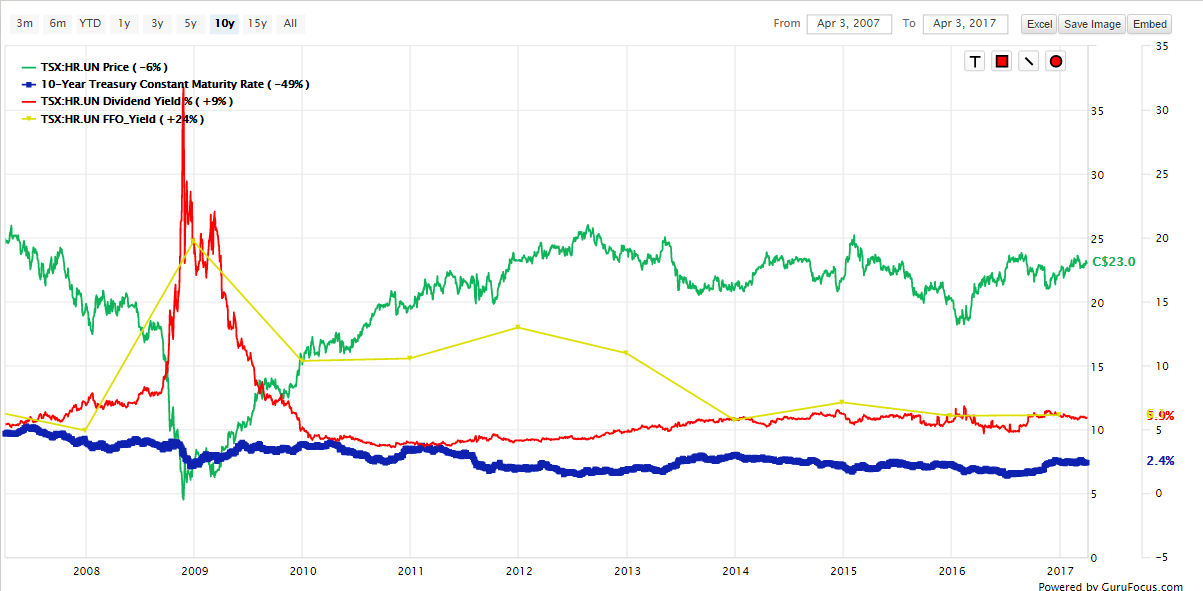

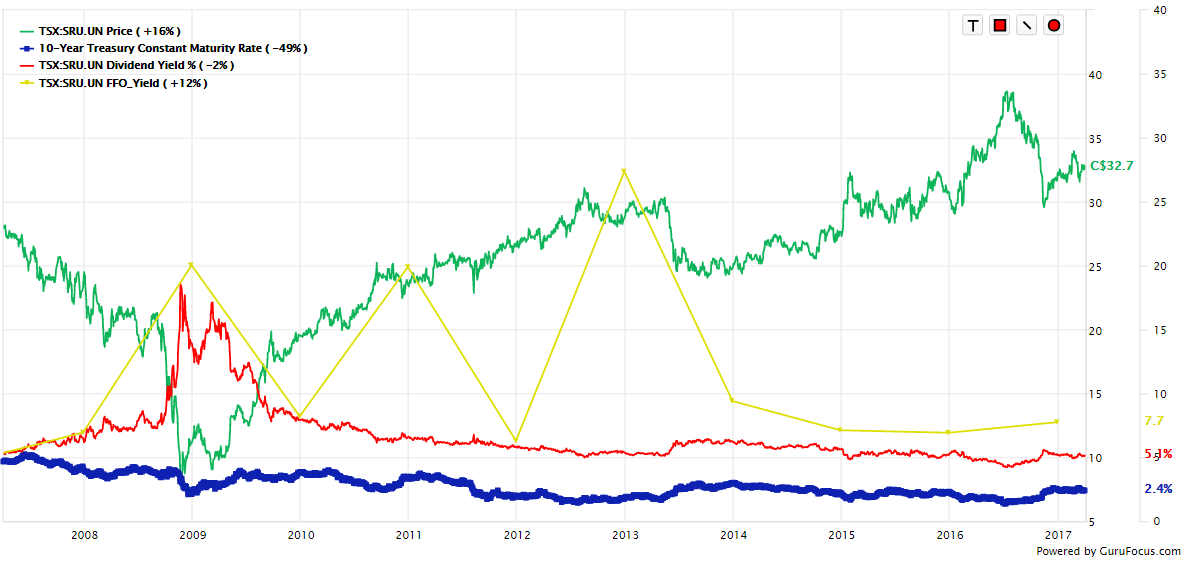

Top 10 Monthly Paying Canadian Dividend Stocks With Large 1 Year Projected Gains Seeking Alpha

Canadian Apartment Properties Reit Is It A Cheap Dividend Stock Otcmkts Cdpyf Seeking Alpha

Reits Canada Still Offers Tax Advantages For These Investments

Canadian Reits Vs U S Reits Which Are Better Buys For Canadians

Reits Explained For Canadians Real Estate Investing For Beginners Passive Income Investing Youtube

Analysis How Fair Tax Fared In Budget 2022 Canadians For Tax Fairness

Dividends A Canadian Dividend Investor S Dream Tawcan

Royal Bank Of Canada Tsx Ry Nyse Ry And Another Stock Are Solid Dividend Ideas Stock Market Crash Economic Trends Stock Market

13 Best Monthly Dividend Stocks In Canada For Passive Income 2022

Canadian Real Estate Investment Trusts Reits